‘Engine Swap’ market hots up with battery electric and hydrogen driveline conversions

- PostedPublished 23 March 2023

A new green technology opportunity has arrived with the electric vehicle (EV) conversion market, potentially worth billions a year to the global automotive aftermarket.

This has given rise to multiple independent startups – such as Australian company Jaunt which recently merged with British outfit Zero EV to create multinational conversion specialist Fellten – as well as established vehicle manufacturers, rushing for a slice of this fast-growing market.

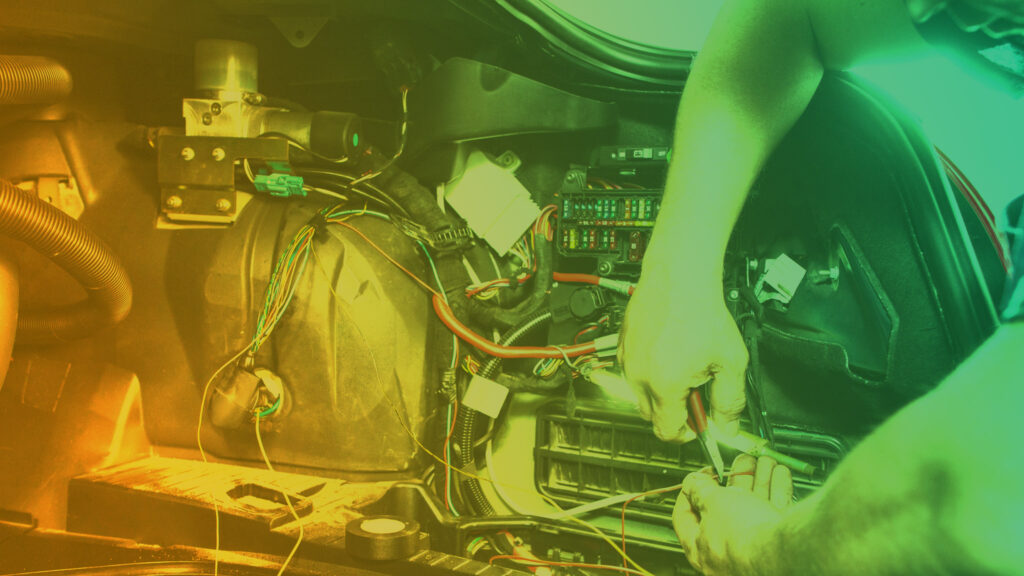

Similar to the time-honoured engine swap process, EV conversions replace an internal combustion driveline with electric motors powered using either a battery pack or a hydrogen fuel cell while keeping the rest of the vehicle and its structure intact.

EV conversions are also seen as a way to extend a petrol or diesel vehicle’s lifespan during the global electric mobility transition, or make classic cars more reliable, enjoyable to drive and eligible to enter zero-emissions zones.

Can EV conversions ever be a mainstream solution?

Roev seems to think so. Launched in Brisbane in 2020, when no one was building electric utes in Australia, Roev saw customers were frustrated by unavailability. Such is demand that the startup has announced it will be converting 1000 HiLux and Ranger utes this year. Roev electric conversions will range from $50K to $60K plus initial vehicle cost. The 240km claimed range rises to 360km with the extended pack.

Eventually, Roev plans to build its own ladder-framed ute from the ground up. Currently only LDV has come to market with the purpose-built $93K eT60, offering a 360km range via the rear wheels only – along with mixed reviews.

Another Aussie company, SEA Electric, is now focusing in on utes, having signed a $1 billion Memorandum of Understanding with MEVCO, which will produce all-electric HiLux and LandCruiser conversions for the mining industry, with a commitment to order 8500 units over the next five years. Half of the 2023 allocation of the Australian-developed electric conversions have been pre-sold, with demonstration models doing the rounds in Melbourne, Brisbane and Perth.

Available in mining-specific 4×4 and 4×2 configurations, the vehicles will utilise an 88kWh battery to provide 380km of range, or a 60kWh battery for 260km of range. Initially the conversions will be carried out on vehicles with combustion engines, although SEA plans to start importing ‘roller gliders’, vehicles from the manufacturer that have never had their engine or ancillary components fitted. SEA says the conversion to electric will have positive health implications for miners, as they will not be exposed to the air pollutants emitted by diesel engines.

Are EV conversions the answer many large fleet operators are looking for?

Australasian road infrastructure services company The Evolution Group recently partnered up with Tembo to convert its 500 combustion-engined utes to battery electric over the next five years. Tembo is a Dutch battery-electric off-road vehicle company that offers EV conversion kits for popular models, such as the HiLux, of which 19 million have been sold globally. This is seen as a good way to streamline production and target demand.

As a result, Tembo was identified as a leader in its field by Nasdaq-listed global renewable services company VivoPower which has acquired 51 per cent of the company. This investment will enable Tembo to significantly scale up its assembly facilities to meet not only The Evolution Group’s order, but also a host of new orders flowing from VivoPower’s potential to grow demand further.

VivoPower has an established base of more than 700 customers across the mining, infrastructure and utilities sectors where demand for transitioning to electric vehicles is accelerating. The company foresees that by entering the lucrative electric light vehicle conversion market, it can reduce its customers’ energy costs while tripling addressable market to US$36 billion.

What about fuel cell EV conversions?

Australian hydrogen fuel cell EV startup H2X Global says its first production Ranger-based Warrego ute will, after compliance testing, go on sale mid-2023.

H2X has said that the orders for the initial 250 Warregos it plans to build have mainly come from energy companies, as well as a handful of private buyers in Australasia, Asia and Europe.

The Warrego features a 60kW fuel cell, 260kW electric motor and 700-bar type 4 hydrogen tank system providing up to 466km of range, four-wheel drive and a towing capacity of 2500kg. The price for this zero-emissions ute starts at $189K.

Similar to Rivian Automotive, which in 2021 made a US$100 billion Nasdaq debut, H2X also plans a major stock exchange listing.

This will provide the funding it needs to move forward with new releases such as the bespoke from-the-ground-up Darling van that can also be used as a taxi or people mover.

Will an established automaker launch a fuel cell ute?

Toyota can see the HiLux ute’s fuel cell potential and is leading a consortium to develop a prototype hydrogen-powered version of its HiLux by retrofitting its proven ‘Gen 2’ Mirai drivetrain and technology, after successfully securing the equivalent of around AU$10 million in funding from the UK government.

This collaboration consists of UK-based technical engineering partners Ricardo, ETL, D2H and Thatcham Research with Toyota Europe R&D providing support. Initial prototypes will be produced at Toyota’s UK Derbyshire plant during 2023.

The UK government said a fuel cell HiLux would be “ideal for use in isolated settings where electric vehicle charging is impractical”. This is particularly true in regions where the grid is not built for high capacity or where the cost of electricity affects viability.

In order to maximise opportunities, is hoped that once the prototypes have been proven the conversion program can be expanded to offer customisations, conversions and accessory fit.

How are other automakers reacting?

Automotive conglomerate Stellantis has partnered with Qinomic, a French sustainable mobility and retrofitting equipment manufacturer, to develop a kit to convert combustion-engined light commercial vehicles to battery electric.

Stellantis said the deal was part of its circular economy commitment to reduce waste by extending the life of its vehicles as a contribution to reaching net zero targets.

The EV conversion also helps protect freedom of mobility by keeping older vehicles longer, particularly where an affordable, sustainable way of accessing ever-growing low-emission zones is essential for business activities. Electric retrofitting trials will take place during this year, with rollout expected in 2024.

Stellantis intends to boost the recycling revenues of its business tenfold and quadruple revenues from extended-life parts and services by 2030.

What about classic car conversions?

Fellten, spawned by a recent merger of two classic car EV conversion specialists, Australia’s Jaunt Motors and Britain’s Zero EV, intends to streamline its international supply chain to enable automotive workshops across Australasia, Europe and North America to offer Fellten EV conversion kits, while bringing costs down. The current price of electrifying a Porsche 911 or Land Rover is around $145K, while the classic Mini comes in at around $50K.

Fellten plans to offer systems that enable classic cars to become daily drivers, with better than manufacturer levels of performance, reliability and safety. To complement this technology, Fellten offers training courses to upskill technicians working with its EV conversion kits. The company is also the only player in the industry to offer ISO certification in quality, environmental, and health and safety management.

What about hydrogen combustion engine conversions?

Toyota has converted the cult classic AE86 into both hydrogen combustion engine and battery electric vehicles. Both concept variants use manual transmissions, although it is the hydrogen combustion engine variant that is gaining most interest.

As Toyota explains, the AE86’s combustion engine only required new fuel injectors, fuel pipes and spark plugs to successfully burn hydrogen drawn from two fuel tanks taken from the Mirai.

Toyota has demonstrated how older existing fossil fuel burners could be converted to burn hydrogen, while still producing the noise and characteristics of petrol engines, with only trace amounts of CO2 and a significant reduction in NOx emissions versus hydrocarbon combustion.

Unfortunately, regardless of Toyota’s ability, neither conversions are available for sale; many expect however that these kits, along with others, will eventually be marketed and sold.

How much can the cost of an EV conversion fall?

To remain a viable option, and in order for growth to continue in this sector, the cost for EV conversions will need to fall. Transition One, which insists it is not a car company but an ecological, waste reduction and climate change company, is attempting to turbocharge cost reduction.

This has in part been brought about by a French government subsidy, for combustion to electric retrofits. Transition One plans to be able to offer EV conversions for popular small city cars in less than four hours, and for less than the equivalent of AU$12.5K (or about $7.5K with the subsidy).

It is currently developing EV conversion kits for the Fiat 500, Mini Cooper, Renault Twingo 2, Renault Kangoo, Renault Clio 3 and the VW Polo 4.

The target audience is local commuters, utilising a 15kWh battery with a 100km range and a restricted speed of 110km/h to meet homologation requirements.

It has already received 10,000 requests and plans to offer the kits by 2025. In order to fulfil demand, Transition One will use existing automotive aftermarket infrastructure to retrofit these kits, which is also an important transition as workshops move from internal combustion to new technologies. The plan is to franchise this model globally.

Transition One insists the culture of car ownership has to change, as automakers have educated us to maintain and resell our cars but never to improve to keep them.

By changing our approach to motoring, our next EVs might just be sitting on the driveway – they’re just awaiting an affordable EV conversion.