NZ carbon price slump could reduce cost of refrigerants but raises other concerns

- PostedPublished 7 July 2023

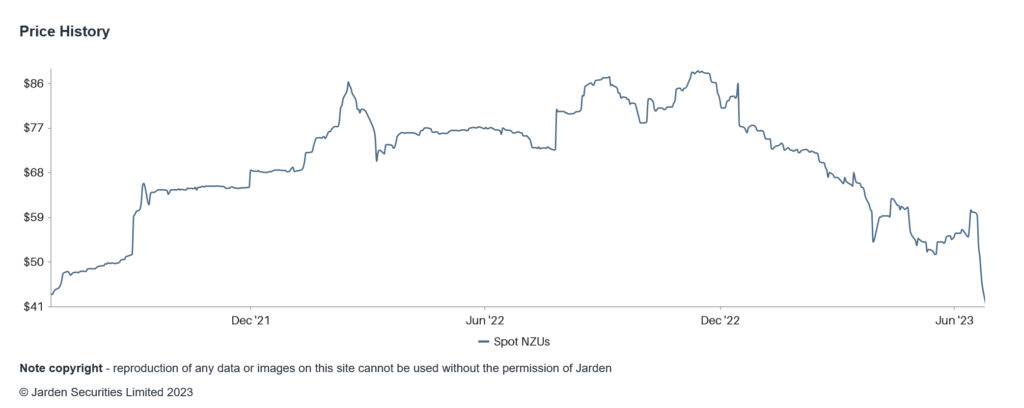

New Zealand’s carbon market, part of the government’s Emissions Trading Scheme (ETS), has hit a two-year low this June, with carbon unit prices falling to NZ$48 (AU$44) per metric tonne of CO2 equivalent from a peak of NZ$88.50 (AU$82) in November 2022.

Although this is unlikely to affect the price of R134a in the short term, a softening of refrigerant pricing could eventually flow through to refrigerant supplies if importers have jumped on this opportunity.

The ETS, established in 2008, is a government policy that sets limits on greenhouse gas emissions for specific industries. Companies can buy or receive permits for their allotted emissions and can sell unused permits to others. This creates a competitive market for trading emissions, incentivising companies to invest in low-carbon emission technology.

Prior to 2021, businesses had the option of paying the government a set amount of $35 (AU$32) per tonne for the carbon they emit rather than being required to buy credits on the open market. While some industries are legally required to hand over carbon credits each May in order to meet their yearly emissions targets, others, such as agriculture, are not.

Low carbon unit prices are a major cause of concern, as they fail to provide sufficient incentives for companies to reduce their emissions. This is because the cost of purchasing carbon units is significantly cheaper than investing in low-carbon technology. The Climate Change Commission (CCC) has suggested that the auction reserve price for 2023 be established at NZ$60 (AU$55).

However, New Zealand’s ETS is currently facing political uncertainty, with an ongoing review of the scheme causing concern among investors about potential changes and an oversupply of carbon credits. This has resulted in a lack of confidence in the market, with potentially significant impacts on the government’s ability to meet its emissions reduction targets under the Paris Agreement.

Alarmingly, this March, New Zealand failed to sell any carbon emission credits despite a price drop, with experts suggesting that companies may be stockpiling credits. Though fewer emissions allowances may result from this, which would be good for the environment, the absence of interest in the auction is also seen as a lack of trust in carbon market policies.

Moreover, the fall in carbon prices cost the government around NZ$1.2 billion (AU$1.1 billion) in lost revenue in the nine months to March, contributing to a deficit wider than originally forecast and hindering the government’s ability to invest in renewable energy to support its transition to a low-carbon economy.

To tackle the problem and regain market trust, policymakers in New Zealand are urgently contemplating measures such as implementing a fresh cap on emissions from industrial processes, raising the cost of carbon credits, and broadening the ETS’s coverage to include more sectors. This is to ensure that the ETS remains an effective tool for reducing emissions and fulfilling the country’s climate goals.

- CategoriesIn Latest News

- Tagscarbon price, carbon tax, emissions trading scheme, New Zealand, NZ, refrigerant